In this article, we will create a custom function to calculate sales tax for the given invoice and sales tax percentage.

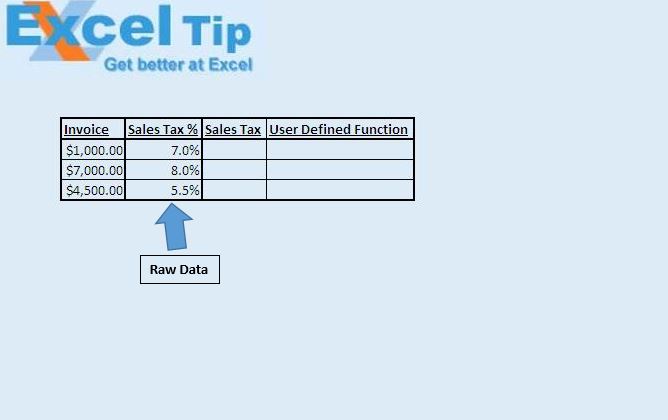

Raw data for this example consists of invoice and sales tax percentage, we will calculate the amount of sales tax included in the amount in an invoice.

We will use custom function “SalesTax” to get the amount of sales tax. This function takes invoice and sales tax percentage as input.

Logic explanation

Below mathematical formula is used to calculate the amount of sales tax when invoice and sales tax percentage are present.

SalesTax = TotalInvoice - TotalInvoice / (1 + TaxPercentage)

We have used the above formula as it is in the “SalesTax” custom function.

Please follow below for the code

Option Explicit Function SalesTax(TotalInvoice As Double, TaxPercentage As Double) 'Formula used for finding the sales tax SalesTax = TotalInvoice - TotalInvoice / (1 + TaxPercentage) End Function

If you liked this blog, share it with your friends on Facebook. Also, you can follow us on Twitter and Facebook.

We would love to hear from you, do let us know how we can improve our work and make it better for you. Write to us at info@exceltip.com

The applications/code on this site are distributed as is and without warranties or liability. In no event shall the owner of the copyrights, or the authors of the applications/code be liable for any loss of profit, any problems or any damage resulting from the use or evaluation of the applications/code.