In this article we will learn about how to calculate the loan amortization schedule in Excel. To calculate loan payment we will use the “RATE”, “NPER”, “PV”, “PMT”, “PPMT” and “IPMT” formulae. All these formulae will help to create the amortization table in Excel.

PMT: Returns the regular monthly payment on the loan (principal + interest) when the interest for each of the monthly payments is constant. Calculates the payment for a loan based on constant payments and a constant interest rate.

Syntax of “PMT” function: =PMT (Rate, Nper, -Loan Amount)

RATE: Returns the percentage of interest on the loan, when the number of payments is constant. Rate is calculated by iteration can have zero or more solutions.

Syntax of “NPER” function: =NPER (Rate, Pmt, -Loan Amount)

PV: The present value, the total amount that a series of future payments is worth now. Returns the current value for a series of payment with a constant interest rate.

Syntax of “PV” function: =PV (Rate, Nper, Pmt)

PPMT: Returns the amount on the principal for a given period for a loan based on periodic, constant payments and a constant interest rate. And also returns the sum of the principal within the monthly payment (the monthly payment is comprised of the principal + interest).

Syntax of “PMT” function: =PPMT (Rate, Which Period, Nper, -Loan Amount)

IPMT: Returns the interest payment for a given period for a loan based on periodic, constant payments and a constant interest rate. And also Returns the amount of the interest within the monthly payment (the monthly payment is comprised of the principal + interest).

Syntax of “IPMT” function: =IPMT (Rate, Which Period, Nper, -Loan Amount)

Let’s take an example:

Determining a monthly payment

Syntax =PMT(rate,nper,pv,fv,type)

Let’s have a quick look at the arguments of this function.

The PMT function is used to calculate the periodic payment for a standard amortizing loan.

Lets take another example -

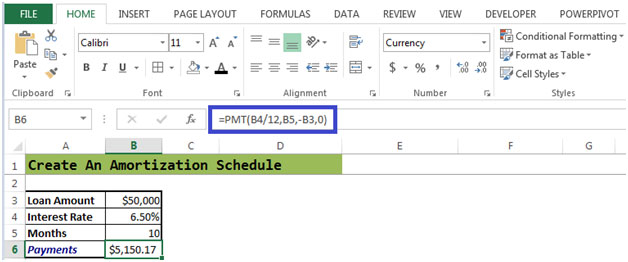

See Figure 2 below:

Figure 2

The monthly payment is $ 5,150.17 for a loan amount of $50,000 and an interest rate of 6.50% for a period of 10 months.

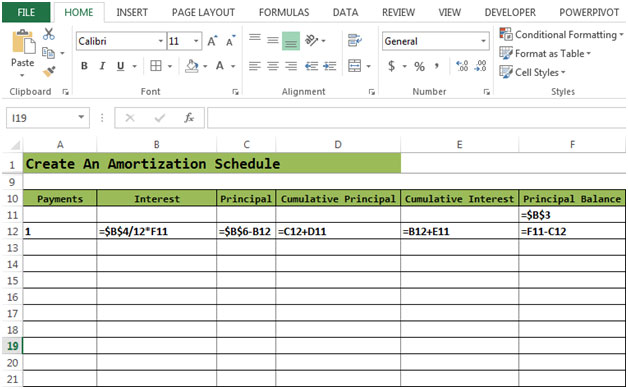

Figure 2a

This figure shows the formulae which have been entered in the required cells.

In Figure 2a, Principle Balance in cell F11=Loan Amount

Principle Balance in cell F12=F11-C12(Interest)

Let’s calculate the Interest, Principal, Cumulative Principal & Cumulative Interest

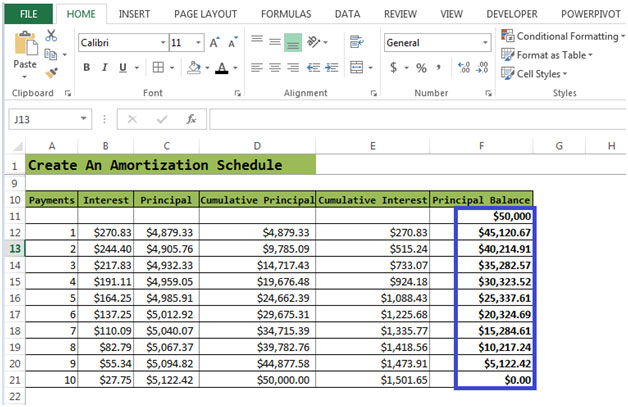

After entering all the formulae:

Figure 2b

The process of interest calculation based on the remaining balance continues until the mortgage is paid off. So each month the amount of interest decreases and amount to pay-off the loan increases. After 10 payments, the mortgage is fully paid off.

The applications/code on this site are distributed as is and without warranties or liability. In no event shall the owner of the copyrights, or the authors of the applications/code be liable for any loss of profit, any problems or any damage resulting from the use or evaluation of the applications/code.

Can a coupon book be made using same amortization schedule?

Is it possible using excel amortization sheet to create the coupon booklet using same existing entries in cell? I can not find anything that does and bring over dates.

"Hi Bobby,

Isn't that exactly what the examples on this pge show you?

If not, please post back with a more detailed query and I'm sure we can help.

Thanks,

Alan."

"Hi Shannon,

Using the following example:

Interest rate: 10% pa

Periods: 60 (5 years, monthly)

Initial loan: $10,000

Final balance = $Nil

Interest charged at end of period

To get the interest payable in any one given period, we can use the IPMT function. For example, the fifth month interest is:

IPMT((110%^(1/2))-1,5,60,10000,0,0)

To get the total interest paid, we simply sum that function for all periods (1 through 60 inclusive), ut entering the following as an ARRAY FORMULA:

{=SUM(IPMT((110%^(1/2))-1,ROW(1:60),60,10000,0,0))}

Note that this must be entered with Shift-Ctrl-Enter to get the braces around the formula. Check Excel's help for more about array formulae.

Alan."

"Hi Des,

It sounds like all you need is to use the NPER function which, ""returns the number of periods for an investment based on periodic, constant payments and a constant interest rate.""

If the rate changes, just re-calculate using NPER or set it up so that each period is re-calculated based on the previous actuals in preceding periods (as for the answer above).

Alan.

Re: Above

Alan Posted on: 31-12-1969

Jeff,

Apologies, I misread your location as your name.

Sorry!

Alan"

"Hi Charles,

Yes you can do this.

Just set up your repayment schedule to refer to the brought forward balance each period (rather than calculate the brought forward balance by reference to the opening scenario).

If you also include a cell for the 'current' interest rate and that is entered each period, you can also generalise for a floating rate calculation, and if you like, forecast foreward what the rates will be.

That approach is also self-correcting if the borrower misses payments or short-pays a period, since it re-claculates based on actuals, not the original theoretical repayment schedule.

You might also want to set up the calculation with extra periods past the original scheduled closure date. That way you can cope with someone who misses or short-pays and then continues with the original repayments, thus extending the period of the loan.

Alan."

"Hi Scott,

Don't know if you still need this answer, but anyway:

If thee are other elements that principle and interest in the periodic payments, then you will need to eliminate them from the payment before applying it to your loan calculation.

Just do that calculation separately in your model before getting into the loan calculation zone.

Alan."

How do I make a amortization sheet for a personal loan to another party.

If I know principal, interest, and # years, how do I calculate total interest paid over the life of the loan considering monthly payments?

What would be the written formula to recalculate the number of payments in months if the interest rate was lowered but the payment stayed the same.

Is it possible to create an amortization spreadsheet that will update (estimate) the associated totals (i.e., prn bal,int paid, int due,etc..) as the payments are entered each month?

what is the formula used to calculate a mortgage payment that includes tax, insurance and any other payment included in my monthly payment?

"Hi Bobby,

Isn't that exactly what the examples on this pge show you?

If not, please post back with a more detailed query and I'm sure we can help.

Thanks,

Alan."

"Hi Shannon,

Using the following example:

Interest rate: 10% pa

Periods: 60 (5 years, monthly)

Initial loan: $10,000

Final balance = $Nil

Interest charged at end of period

To get the interest payable in any one given period, we can use the IPMT function. For example, the fifth month interest is:

IPMT((110%^(1/2))-1,5,60,10000,0,0)

To get the total interest paid, we simply sum that function for all periods (1 through 60 inclusive), ut entering the following as an ARRAY FORMULA:

{=SUM(IPMT((110%^(1/2))-1,ROW(1:60),60,10000,0,0))}

Note that this must be entered with Shift-Ctrl-Enter to get the braces around the formula. Check Excel's help for more about array formulae.

Alan."

"Jeff,

Apologies, I misread your location as your name.

Sorry!

Alan"

"Hi Des,

It sounds like all you need is to use the NPER function which, ""returns the number of periods for an investment based on periodic, constant payments and a constant interest rate.""

If the rate changes, just re-calculate using NPER or set it up so that each period is re-calculated based on the previous actuals in preceding periods (as for the answer above).

Alan."

"Hi Charles,

Yes you can do this.

Just set up your repayment schedule to refer to the brought forward balance each period (rather than calculate the brought forward balance by reference to the opening scenario).

If you also include a cell for the 'current' interest rate and that is entered each period, you can also generalise for a floating rate calculation, and if you like, forecast foreward what the rates will be.

That approach is also self-correcting if the borrower misses payments or short-pays a period, since it re-claculates based on actuals, not the original theoretical repayment schedule.

You might also want to set up the calculation with extra periods past the original scheduled closure date. That way you can cope with someone who misses or short-pays and then continues with the original repayments, thus extending the period of the loan.

Alan."

"Hi Scott,

Don't know if you still need this answer, but anyway:

If thee are other elements that principle and interest in the periodic payments, then you will need to eliminate them from the payment before applying it to your loan calculation.

Just do that calculation separately in your model before getting into the loan calculation zone.

Alan."

How do I make a amortization sheet for a personal loan to another party.

If I know principal, interest, and # years, how do I calculate total interest paid over the life of the loan considering monthly payments?

What would be the written formula to recalculate the number of payments in months if the interest rate was lowered but the payment stayed the same.

Is it possible to create an amortization spreadsheet that will update (estimate) the associated totals (i.e., prn bal,int paid, int due,etc..) as the payments are entered each month?

what is the formula used to calculate a mortgage payment that includes tax, insurance and any other payment included in my monthly payment?